SpaceTech Industry in Figures

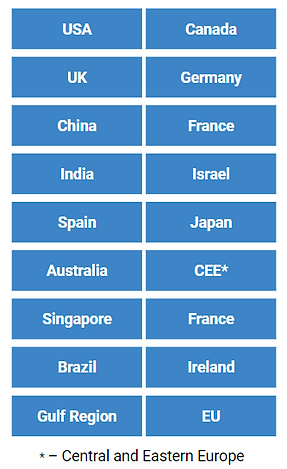

Global SpaceTech Ecosystem 2021

Funding by Region (demo)

Company Regional Distribution (by Number of Companies)

Company Regional Distribution (by Categories and Number of Companies)

The Global SpaceTech Economy

Showing stable growth, the global SpaceTech economy was valued at $380B in 2020 and is expected to grow to $10T by 2030.

According to the most conservative estimates, it accounts for 0.5% of the global GDP.

This will have a dramatic impact on the annual growth in the global SpaceTech market, and mainly because of the growth of the Space Exploration sector and advances in IT, FinTech, and other digital technologies.

SpaceTech Publicly Traded Companies

Despite the crisis and dramatic fall in companies’ capitalization in February 2020, the capitalization of 376 publicly traded companies grew from $3,410B on February 3, 2020, to $4,030B on March 18, 2021.

The largest companies by market capitalization are Honeywell International, The Boeing Company, Raytheon Technologies Corporation, and Lockheed Martin Corporation.

SpaceTech companies are similar to other companies in the sector (i.e. the ones that reached series B or C funding rounds), which means that the growth in their market capitalization can be an approximation of the dynamics in the entire sector. Anticipated growth in the industry is expected to impact favorably market capitalization of SpaceTech corporations.

SpaceTech Market Capitalization

Our SpaceTech stock index includes more than 350 corporations operating in the space and IT sectors. Their market capitalization demonstrates significant growth, exceeding that of the entire market (represented as the S&P 500 index), as well as the general SpaceTech industry indices (ROKT and ITA). The SpaceTech stock market segment is, therefore, less volatile compared to them (as measured by standard deviation).

Interestingly, the distribution of returns in the SpaceTech stock market segment is right-skewed - a demonstration of the low likelihood of left tail events (sometimes referred to as “black swan events”) happening. Despite the negative skewness, the value is small, which means that the likelihood of the so-called “black swan event” is much lower in comparison to the S&P 500. A negative Curtosis means that the distribution is flatter than a normal curve with the same mean and standard deviation.

Top 10 Investment Deals

-

Valued at $1.8B, the largest investment deal represents a post-IPO investment in Infrastructure Wireless Italiane.

-

The second-largest deal, valued at $1.57B, represents private equity investment in T-Mobile.

-

Valued at $1.1B, the third-largest investment involves Wipro Technologies.

-

Valued at $1.05B and $1B, investments in Equinix and Alibaba are the 4th and 5th largest investments in the industry.

-

Estimated at $0.9B, the 6th largest deal is a private equity investment in Genesys.

-

The 7th largest deal, worth $0.846B, is post IPO equity investment in Zain Group.

-

Valued at $0.75B, investment in BMC Software is considered to be the 8th largest in the industry.

-

Valued at $0.75B and $0.65B, deals involving Nutanix and Pivotal are the 9th and 10th largest in the industry.

Dynamics of Investments in SpaceTech

Valued at $4.75B, the SpaceTech financial services sector is the largest in the SpaceTech industry. Some of the most active capital-raising sub-sectors include aerospace financial services, aerospace travel air transportation, and aerospace Internet.

The distribution of investments across different SpaceTech sectors demonstrates that most of the subsectors in the industry are rapidly growing. Summing up, both governmental and private investors are interested in the SpaceTech industry and determined to continue investing in it.

Top 10 Countries in SpaceTech Sector in 2021

With a total of $28B invested in 3,086 companies, the US is an undisputed leader in terms of SpaceTech investments. This is approximately 6 times the amount invested in SpaceTech companies in China - the second-largest country in terms of SpaceTech investment ($4.786B invested in 122 companies). China is closely followed by the United Kingdom where funding is mostly raised from public sources and IPOs, and not by way of private funding.

Top 10 Countries in SpaceTech Sector in 2021

Top Satellite Companies